Crafting a partnership agreement is a crucial step in ensuring the success of your business venture. This article delves into the essentials of partnership agreements, highlighting key elements to include, such as roles and responsibilities of partners, financial contributions, and profit distribution. It also covers vital aspects like conflict resolution, dispute management, and legal compliance. By understanding these components, you can draft and review a robust partnership agreement that safeguards your interests and promotes smooth collaboration. Whether you’re forming a new partnership or revising an existing one, these insights will guide you through creating a comprehensive and legally sound agreement.

alijyun.com will provide a detailed exploration of this topic.

1. Understanding Partnership Agreements

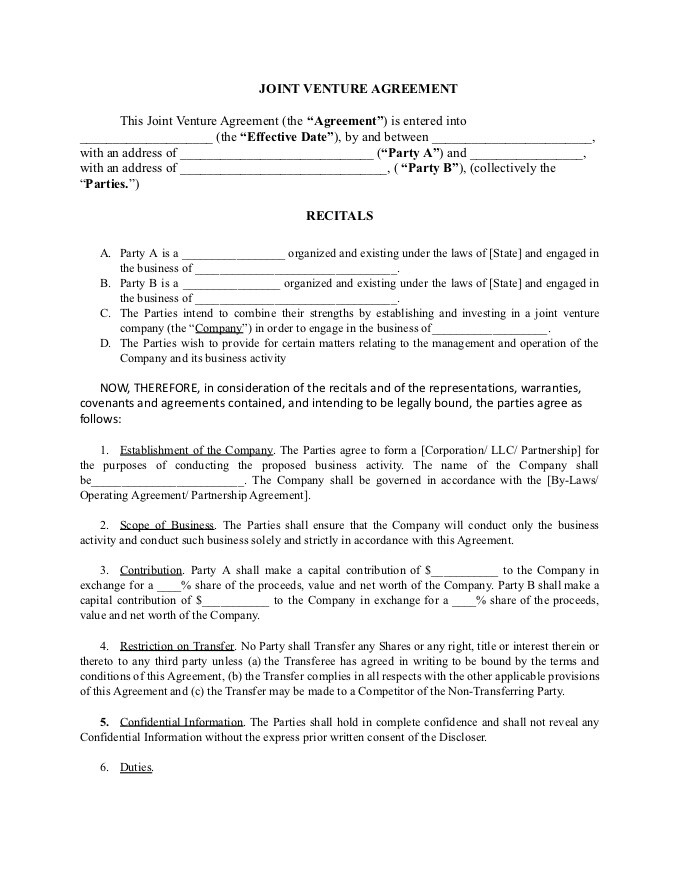

A partnership agreement is a foundational document that outlines the terms and conditions of a business partnership. It serves as a legal contract between partners, defining their relationship, roles, and responsibilities. Understanding the intricacies of a partnership agreement is essential for establishing clear expectations and ensuring a harmonious business operation. This agreement typically includes information about the partnership’s purpose, duration, and the contributions of each partner, whether financial, intellectual, or otherwise. It also delineates the decision-making process, management structure, and procedures for admitting new partners or handling withdrawals. By setting these parameters, a partnership agreement helps prevent misunderstandings and conflicts, providing a structured framework for resolving disputes and making business decisions. Moreover, it ensures compliance with relevant laws and regulations, protecting the interests of all partners involved. Crafting a well-defined partnership agreement is crucial for the success and longevity of any business venture, as it lays the groundwork for effective collaboration and mutual benefit.

2. Key Elements to Include in a Partnership Agreement

A comprehensive partnership agreement must encompass several key elements to ensure clarity and prevent future disputes. Firstly, the agreement should clearly state the partnership’s purpose and goals, providing a shared vision for all partners. The roles and responsibilities of each partner must be explicitly defined to avoid overlap and confusion. This includes outlining decision-making authority and management duties.

Financial aspects are crucial; the agreement should detail each partner’s financial contributions, profit and loss sharing ratios, and procedures for capital withdrawals. It is essential to include provisions for conflict resolution and dispute management, specifying the steps to be taken in case of disagreements. Additionally, the agreement should address the process for admitting new partners, as well as the terms for the exit of existing ones, ensuring a smooth transition.

Legal compliance is another critical element, necessitating adherence to relevant laws and regulations. By incorporating these key elements, a partnership agreement can provide a solid foundation for a successful and harmonious business venture.

3. Roles and Responsibilities of Partners

Defining the roles and responsibilities of partners is a critical component of a partnership agreement. Each partner’s role should be clearly delineated, detailing their specific duties and areas of authority within the business. This clarity helps prevent misunderstandings and ensures that each partner knows what is expected of them. For instance, one partner might be responsible for financial management and accounting, while another focuses on marketing and sales.

In addition to daily operational roles, the agreement should specify decision-making processes, including how decisions are made and who has the authority to make them. This might involve outlining the voting rights of each partner and the procedures for resolving deadlocks in decision-making.

Responsibilities also extend to financial obligations, such as the initial capital investment each partner is required to make, ongoing financial contributions, and how profits and losses are to be distributed. Clearly defining these roles and responsibilities not only streamlines business operations but also fosters accountability and collaboration among partners, contributing to the overall success and stability of the partnership.

4. Financial Contributions and Profit Distribution

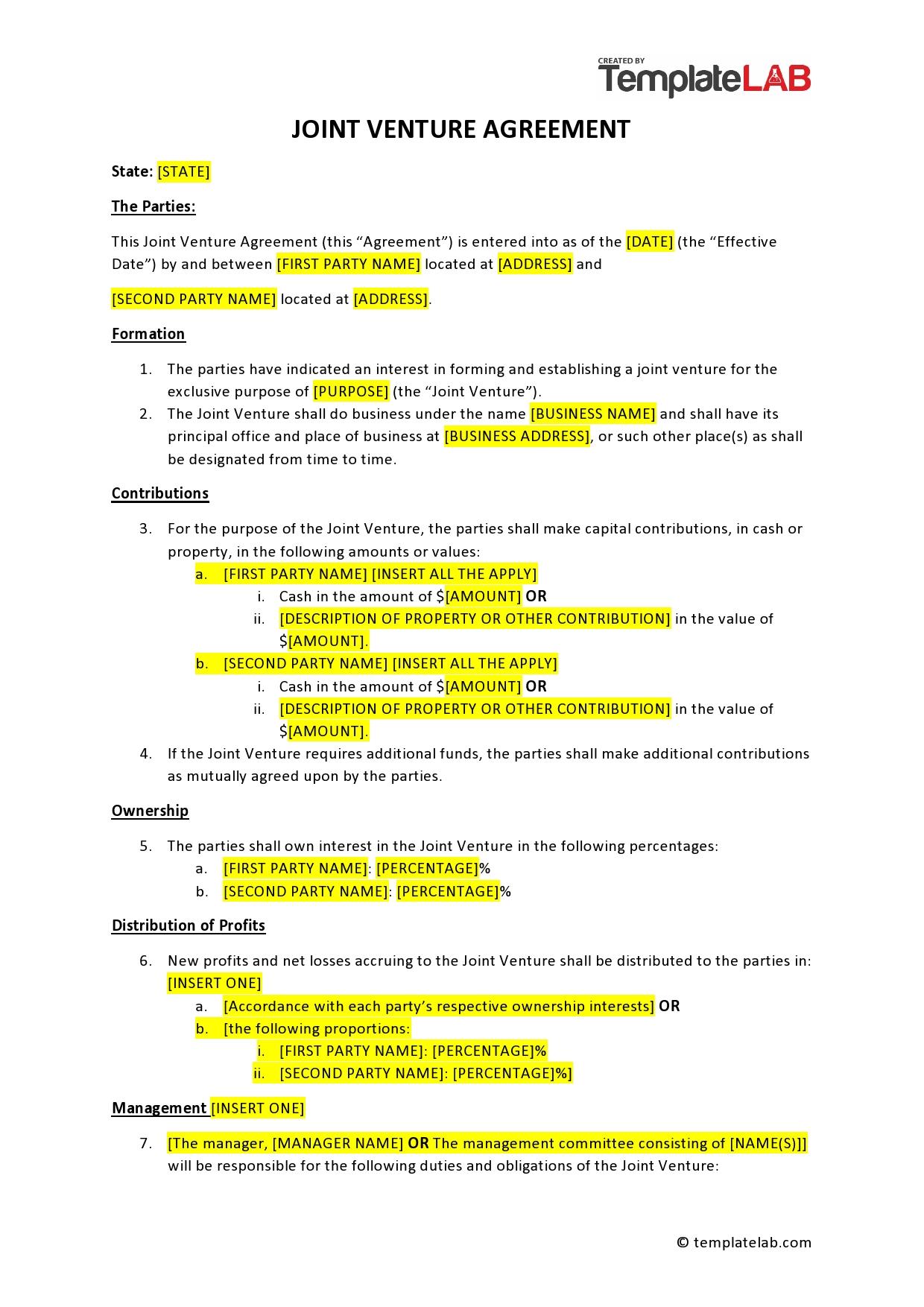

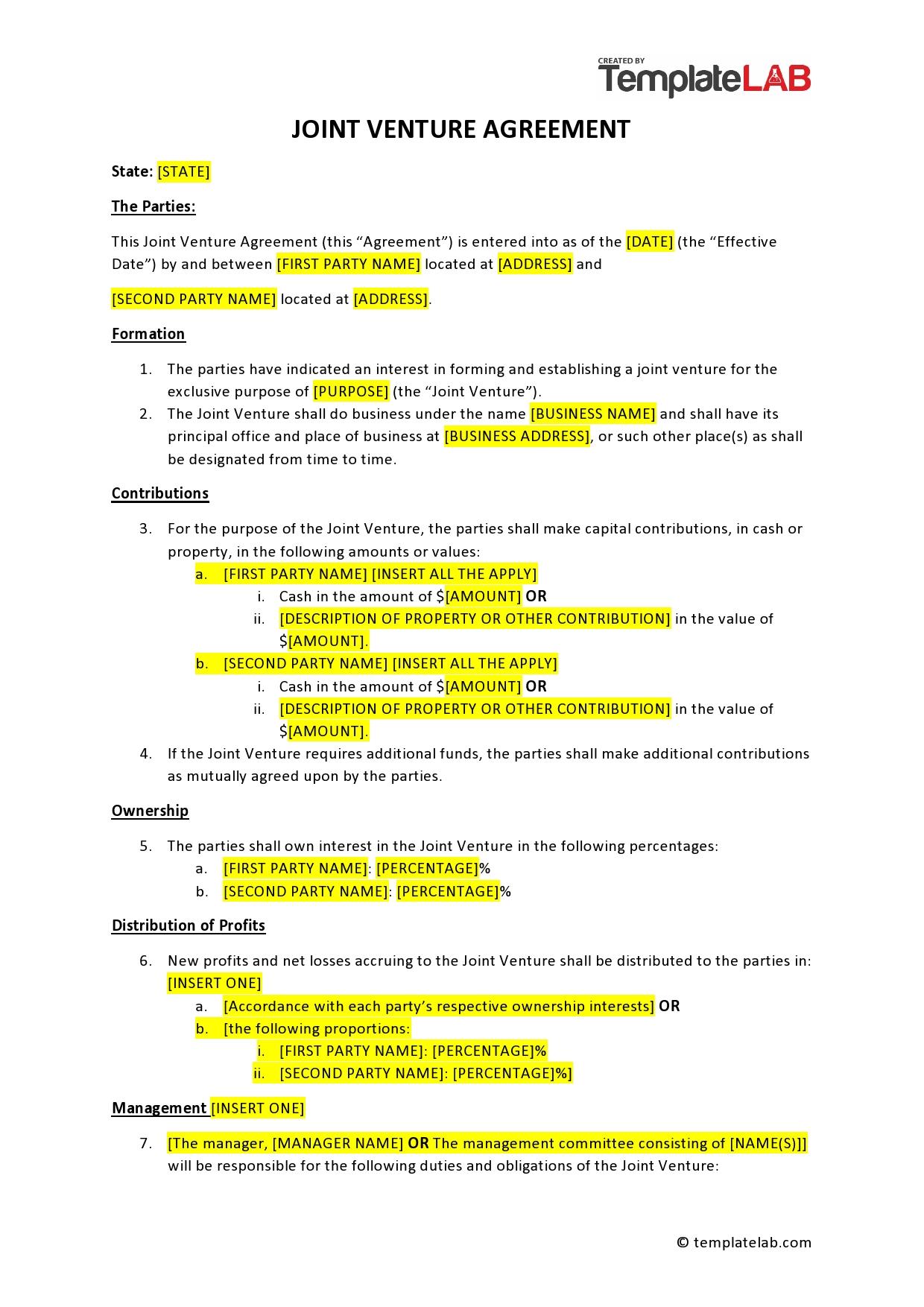

Financial contributions and profit distribution are pivotal aspects of a partnership agreement. Each partner’s financial contributions, whether in cash, assets, or services, should be explicitly detailed. This clarity ensures that all partners understand their initial and ongoing financial commitments. The agreement should also outline the procedure for additional capital contributions if needed, including how these contributions will be valued and recorded.

Profit distribution is another critical component. The agreement must specify how profits and losses will be shared among partners. This can be based on the proportion of each partner’s initial investment, their ongoing contributions, or other agreed-upon metrics. Clear guidelines on profit distribution help prevent conflicts and ensure transparency.

Additionally, the agreement should address the timing and method of profit distributions. Partners need to know when they can expect to receive their share of the profits and how these distributions will be handled. By providing detailed information on financial contributions and profit distribution, the partnership agreement lays a solid foundation for financial transparency and equitable treatment of all partners, fostering trust and collaboration.

:max_bytes(150000):strip_icc()/Generalpartnership_final_rev-8eda351ea7424cb4bd6a885f2bcaa040.png)

5. Conflict Resolution and Dispute Management

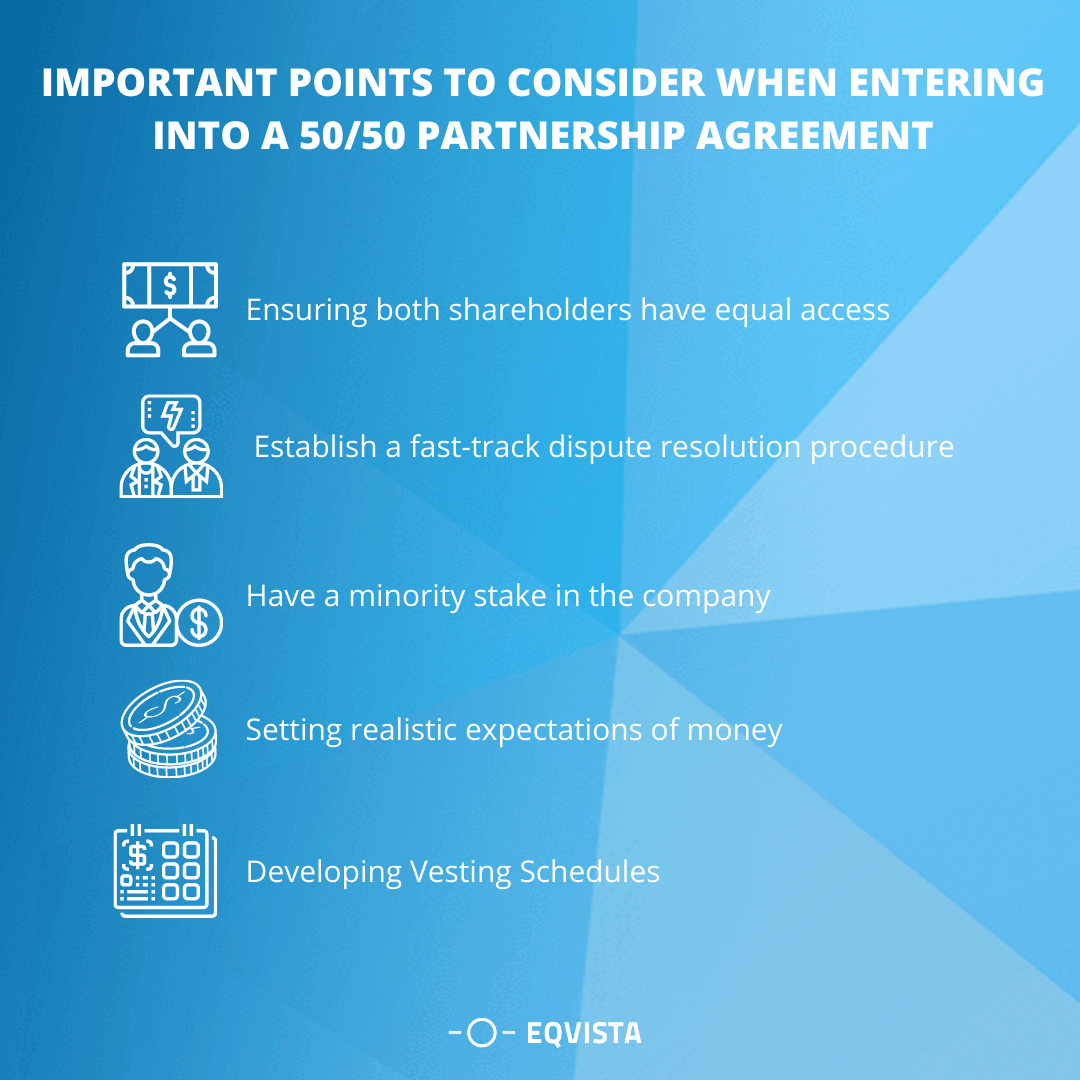

Conflict resolution and dispute management are essential components of a partnership agreement to ensure smooth operation and long-term success. A well-crafted agreement should include clear procedures for handling disagreements and conflicts that may arise between partners. This typically involves outlining a step-by-step process for dispute resolution, starting with internal discussions and negotiations aimed at reaching a mutual agreement.

If internal resolution fails, the agreement should specify alternative dispute resolution methods, such as mediation or arbitration, before considering litigation. Mediation involves a neutral third party facilitating discussions to help partners find a compromise, while arbitration entails a binding decision made by an impartial arbitrator. These methods are often preferred for their efficiency and cost-effectiveness compared to court proceedings.

The agreement should also define how disputes affecting business operations will be managed to minimize disruption. This might include temporary measures for decision-making or operational control during disputes. By incorporating comprehensive conflict resolution and dispute management mechanisms, a partnership agreement can help maintain positive relationships among partners and ensure that conflicts are resolved efficiently, preserving the partnership’s stability and success.

6. Legal Considerations and Compliance

Legal considerations and compliance are critical to the integrity and sustainability of any partnership agreement. It is essential that the agreement adheres to all relevant local, state, and federal laws governing partnerships and business operations. This ensures the agreement’s enforceability and protects the partners from legal disputes or regulatory penalties.

One of the first legal considerations is the formal registration of the partnership, which may involve filing specific documents with governmental authorities. The agreement should specify the business structure, whether it is a general partnership, limited partnership, or limited liability partnership, each with its own legal implications and requirements.

Compliance with tax laws is another crucial aspect. The agreement should detail how taxes will be handled, including the allocation of tax liabilities among partners and the maintenance of accurate financial records for tax reporting purposes. Partners must be aware of their individual tax responsibilities and the partnership’s obligations to file returns and pay taxes.

The agreement should also address issues such as intellectual property rights, confidentiality, and non-compete clauses to protect the partnership’s assets and competitive position. Including provisions for periodic legal reviews ensures that the agreement remains compliant with changing laws and regulations.

By thoroughly addressing legal considerations and compliance, a partnership agreement provides a robust framework that safeguards the partnership and its partners from potential legal challenges and liabilities.

7. Steps for Drafting and Reviewing Your Partnership Agreement

Drafting and reviewing a partnership agreement involves several essential steps to ensure it is comprehensive and effective. Start by clearly outlining the purpose and goals of the partnership, setting a solid foundation for the agreement. Next, gather all relevant information regarding the roles, responsibilities, and financial contributions of each partner. This ensures that all critical aspects are addressed from the outset.

Consulting with legal and financial professionals is crucial during the drafting process. Their expertise can help identify potential legal pitfalls and financial considerations that might otherwise be overlooked. Once a draft is prepared, review it thoroughly with all partners, ensuring that everyone understands and agrees with the terms.

Incorporate feedback and make necessary revisions to the draft. It’s essential to reach a consensus among all partners to avoid future conflicts. After finalizing the agreement, have it reviewed by a legal expert to ensure compliance with all relevant laws and regulations.

Finally, formalize the agreement by having all partners sign it, and consider periodic reviews and updates to keep it aligned with the partnership’s evolving needs and legal requirements.

In conclusion, a well-crafted partnership agreement is vital for the success and smooth operation of any business venture. By clearly defining roles, financial contributions, and profit distribution, as well as addressing conflict resolution and legal compliance, partners can establish a strong foundation for their collaboration. Thoroughly drafting and reviewing the agreement with professional guidance ensures that it meets legal standards and effectively manages potential issues. A comprehensive partnership agreement not only protects the interests of all partners but also fosters a positive and productive business relationship.

alijyun.com

alijyun.com